SMEs Banking

SMEs Banking that allows you to empower your customers in the management of their finances, through tools and solutions designed for them.

Omnichannel Experience

The same experience: Regardless of how or where customers interact using digital channels, for them, the Bank will always be one. Offer a dynamic experience from any device or channel, adapting to the strengths of each one and to each customer journey. And providing 100% of the functionalities in all channels.

Customization

Platform customization adjusted to the needs of your Bank. The ideal balance between an effective solution and the ability to personalize, implement and customize functionalities and the identity of the Bank will give your business a winning differentiator.

One-to-one communication

By means of our automated marketing platform specialized in financial services, your Bank will be able to transform its sales capacity from macro-segmented to micro-segmented campaigns. Empower the Bank team by giving it the possibility to go from handling 10 campaigns per month to 150, with a tool that automates most of the repetitive tasks, so time is dedicated to the value of the offer and not to the segmentation and delivery work on multiple channels.

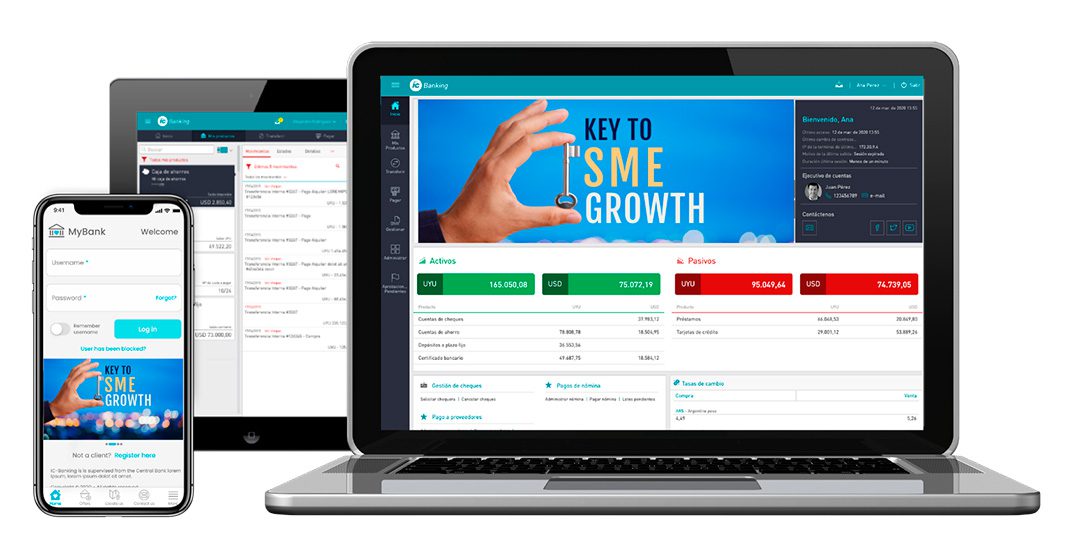

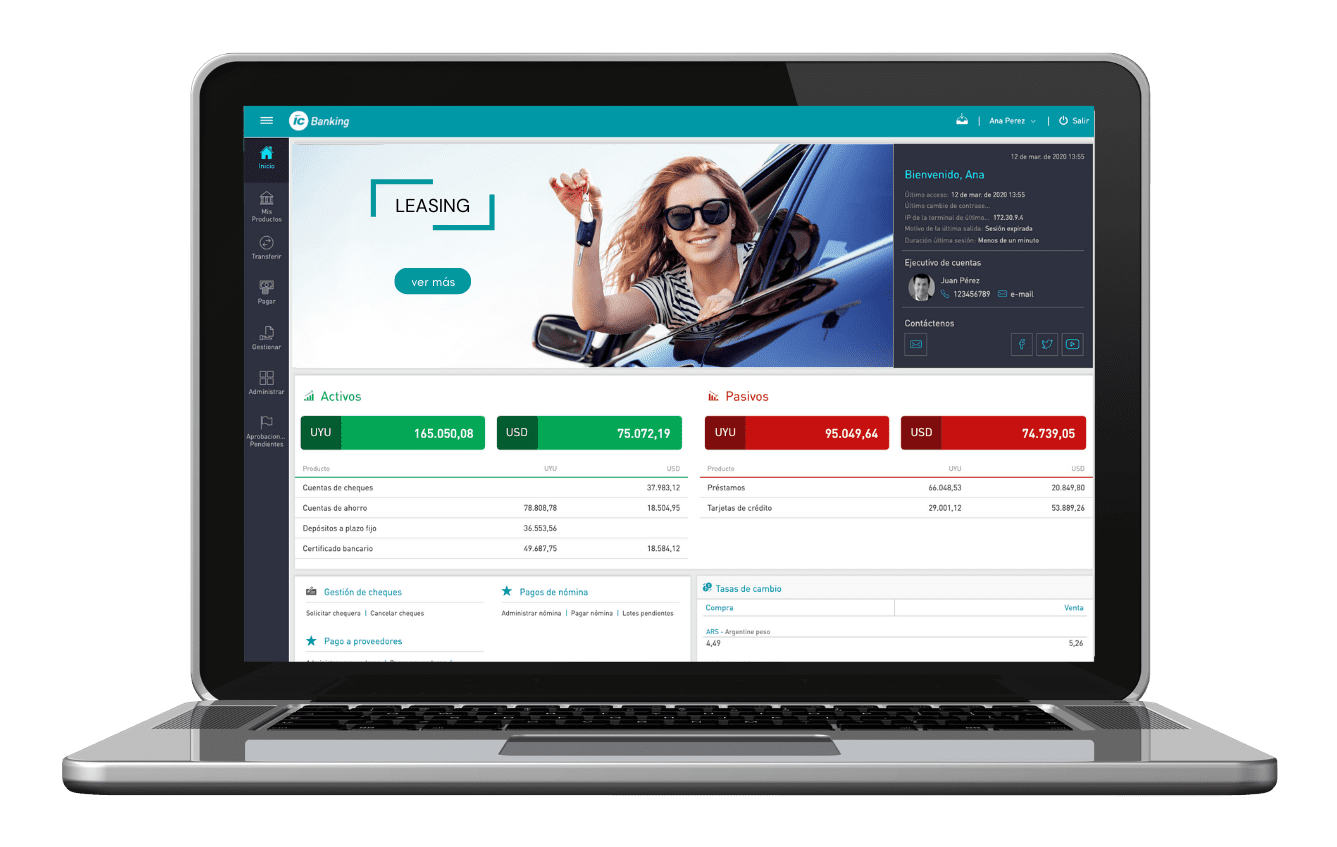

Money Dashboard

Offer your customers a view adjusted to the needs of a corporate customer, allowing them to quickly access their financial situation, favorites and latest movements. And let them easily and efficiently manage their multiple accounts through grouped account views and views grouped by favorites. Turn your Bank into a business enabler and allow your customers to manage their finances efficiently.

Self-management capabilities

Provide your customers with independence in the management of users, permissions, rules and definitions among multiple options for signature schemes that can be configured by company. Reduce the operating costs of your Bank by means of a tool that allows companies to self-manage the usual tasks of managing accounts, managing users, permissions, signature schemes, limits.

List-based payroll payments

It offers SMEs that do not have systems to generate files for payroll payments the ability to manage the payroll through their Home Banking. It creates differentiation and loyalty through empathy and added value.

Supplier Payments

Not all SMEs have tools to manage supplier payments; our HomeBanking grants them access to payment solutions through the generation of files for list-based payments.

Dynamic solutions for credit applications

It allows your SMEs customers to easily access their customized loan applications through the management of dynamic forms by the Bank’s back office.

Multiple transfers

Enable your customers to make multiple transfers of different types, regardless of whether they are local or international, at one time and with a single signature process.

Asynchronous unattended processes

Add value to your customers by means of our asynchronous unattended processes solution that provides the possibility to continue working and browsing within the Bank while their movements and transactions are executed in parallel.

Payment and transaction schedules

Allow your customers to be efficient in managing payments and transactions by means of the programmed schedule system

Products & Services

- Check management

- Commissions

- Photo check deposits

- Signature matrix engine

- Asynchronous unattended processes

- Investment Products

- Credit Lines

- Bank Guarantee Certificate

- Granular permission management

- Approval in Native Apps

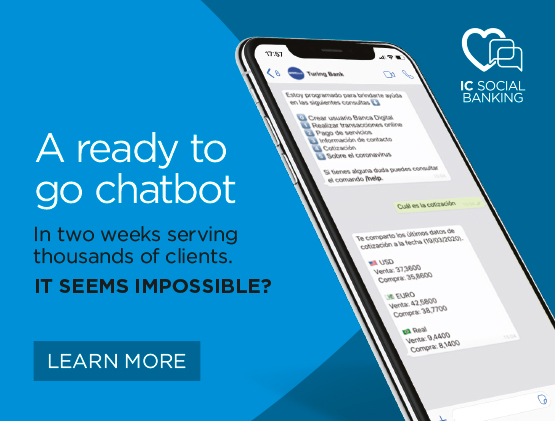

Innovation

Catch our product’s innovation train

You can provide improvements and news for your customers continuously, both through our Software Evolution Area (SEA), which enables a development tailored to the needs of your business, as well as by incorporating the annual innovations of our product that arise out of our experience and knowledge of the needs of banks in the region.

Open Bank Ecosystems

New Open Api connectivity layer to generate new business models and an ecosystem with new products and services that respond to customer demands and make it possible for your Bank to make a difference.